Step-by-Step Guide to Completing Your Annual CTAPP Certification (with pictures)

Ryan Little is a legal ethics lawyer and the founder of Little Legal. He advises lawyers and law firms on all manner of ethics issues. This post shows how Ryan completed his own annual CTAPP certification. If you need CTAPP help, Ryan can be reached at Ryan@LittleLegal.com.

If you're a California lawyer who handles client funds, you must complete the Client Trust Account Protection Program (CTAPP) certification each year. The deadline for 2025 is fast approaching—and failure to complete your certification can lead to non-compliance penalties or even administrative suspension.

This post walks you through how to complete your annual CTAPP reporting step by step, with screenshots that I took while doing my own certification.

What Is CTAPP and Who Has to File?

CTAPP is a compliance program from the State Bar of California to ensure lawyers are following the rules for client trust account management.

You need to file your CTAPP certification if, during the reporting year:

You were responsible for trust account compliance, or

You maintained or oversaw client funds or a trust account.

As a general rule, every California lawyer in private practice must report.

Step-by-Step Instructions for CTAPP Reporting

✅ Step 1: Log In to Your State Bar Profile

Enter your license number and password

Click Go to Dashboard

From your dashboard, click “Complete CTAPP Reporting”

Your profile “home screen,” which you’re taken to immediately upon logging in to your “My State Bar Profile.” From this screen, click Go to Dashboard.

From your compliance dashboard, click Complete CTAPP Reporting.

✅ Step 2: Complete the Screening Question

If you were responsible for complying with trust accounting rules in 2024, select Yes. As discussed above, this question is purposefully broad, and should capture almost every California lawyer in private practice at a law firm—regardless of whether you practice in the state or not. Our firm represents clients in California, Hawaii, and Alabama, and we secure that representation through payment of a retainer, so I clicked Yes.

Then, click Save & Continue.

The screening question is broad. If you’re in private practice and not at a non-profit, you almost certainly need to click “Yes.”

✅ Step 3: Annual CTA Reporting

After you click Save & Continue on the screening question, you’ll be taken to your Annual Client Trust Account Reporting screen. There are two questions for you to answer. The first is whether you or your firm maintains an IOLTA client trust account in any jurisdiction. If so, you’ll need to check the first box unless your firm is enrolled in the State Bar’s agency billing program.

The next question asks whether your firm maintains any non-IOLTA client trust account. This is a trust account where interest on the account is paid to the client or other person, rather than to the California State Bar. These are rare. Most lawyers never encounter a need to use a non-IOLTA trust account. My firm does not maintain one, therefore, I clicked the “No” option.

After making your selection, click Save & Continue.

✅ Step 4: Register Client Trust Accounts

You’ll next be taken to a screen which shows you the information you’ll need to properly register your client trust accounts with the State Bar. There’s no information to input on this screen, so, once you review it, click Continue.

You’ll then be taken to a screen where you can add all your applicable client trust accounts, if they’re not already on file. To get started, click Add Account.

Once you click Add Account, you’ll be taken to a screen where you’ll need to manually input the client trust account information for all your applicable client trust accounts.

At the outset, be sure to properly select whether the account you’re registering is a California IOLTA or a non-California IOLTA. If you mess up and later change your selection, it’ll erase any unsaved information you’ve already input on this screen.

To register your accounts, be sure you have the following information handy:

Account type (CA-IOLTA, Non-IOLTA, etc.)

Routing number, account number, bank name

Ending balance as of December 31

Open and close dates

State in which the account is registered (for non CA-IOLTAs only)

Once you’ve input all necessary information, click Save & Continue. You’ll be re-directed back to the prior “Account Registration” screen, where you can click Continue.

✅ Step 5: Complete the Self-Assessment

Once you complete your account registration, you’ll be taken to the CTAPP self-assessment. These questions are primarily about whether you properly handle and hold client funds. If you’re doing everything correctly, the answer to each question should be “Yes.” That said, it’s crucial that you’re honest here, as dishonesty could lead to serious discipline—possibly including the loss of your license.

If you don’t know whether you’re properly in compliance, contact us and we’ll be happy to help you.

Here’s how I answered the questions:

My answers to questions 1-3 of the self-assessment.

My answers to questions 4-6 of the self-assessment.

My answers to questions 8 and 9 of the self-assessment.

My answers to questions 10-13 of the self-assessment.

My answer to question 14 of the self-assessment.

Once you complete the self-assessment, click “Save & Continue.”

✅ Step 6: Certification of Compliance

The next screen is the certification screen. This is where you certify whether you’re in compliance with California’s rules governing trust accounting and the handling of client funds. Again, if you’re doing things the right way, you should choose the first option. That said, please be honest here. Dishonesty here could be a existential threat to your law license.

If you don’t know whether you’re in compliance, please contact us. We’d be happy to guide you through this process.

Next, click Save & Continue.

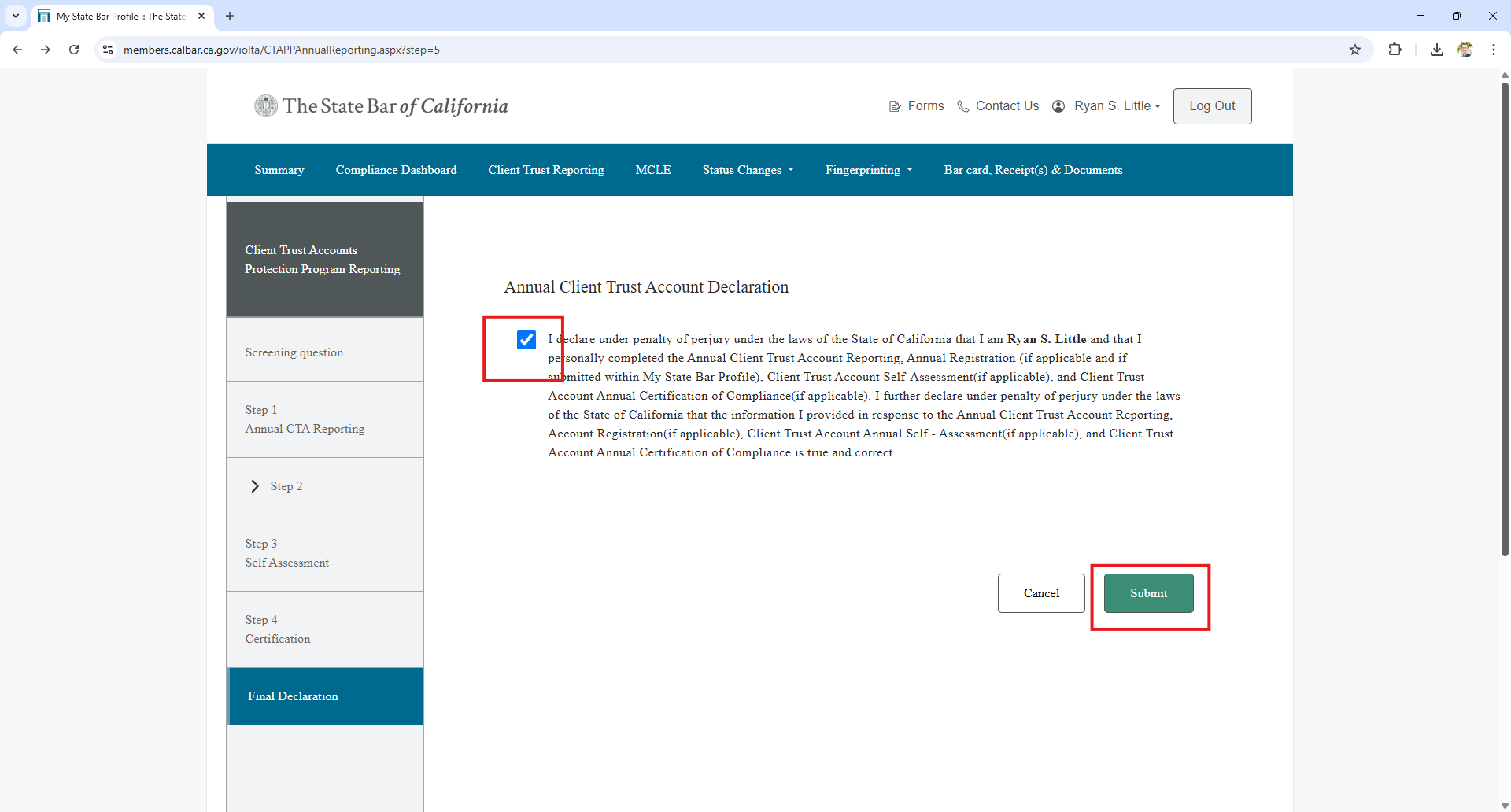

✅ Step 7: Final Declaration

The last screen is a declaration, executed under penalty of perjury, that the information you personally completed the annual reporting, and that the information you provided is true and correct. Honesty is, again, paramount here.

Click Submit—and you’re done!

Need more help with CTAPP or trust accounting compliance?

At Little, legal ethics is what we do.

With extensive experience in trust account management and compliance, we can help you and your firm Do the Right Thing when it comes to navigating the complexities of CTAPP or any other trust accounting issue you’re facing.

Let us help you protect your license, reputation, and practice. Call us at 808-265-9895, email Ryan directly at Ryan@LittleLegal.com, or fill out the contact form below. All inquiries will receive a response within 24 hours.